ESG or Environmental, Social and Corporate Governance is quickly becoming the global standard for investors seeking responsible investment opportunities. This framework requires companies to provide deep transparency and rigorous data, sparking a revolution in how corporate value is assessed. ESG will force companies to put digitalization and traceability at the center of their operations, requiring a reassessment of each layer of business—from facilities to executive decision-making.

ESG – a market revolution against an era of “greenwashing”

Sustainability. Corporate Responsibility. Impact. These terms have been part of the corporate vocabulary for years, dating back to the 1960s. In the modern era, the idea that corporations must be responsible citizens—tangibly giving back and remaining visibly accountable for negative externalities is now central to corporate strategy.

While sustainability and corporate responsibility are now seen as competitive advantages, “greenwashing” has unfortunately become a widespread problem. When faced with the hard and challenging work of overhauling legacy unsustainable practices, many companies have found it convenient to give the impression of commitment through big talk and misleading publicity.

Ironically, greenwashing is itself proving unsustainable. Consumers and investors are aware of greenwashing and pushing back against companies that only “talk the talk.” At the governmental level, standards are being written into law and strictly enforced. Today there are laws pushing back against greenwashing from the EU to Australia, and governments like China’s now require strict corporate data reporting on CO2 emissions, waste management, and other metrics.

But the biggest driver of change may be coming from the market and the world of responsible investment – the root of the ESG revolution fomenting worldwide. Investors are aligning behind ESG frameworks demanding tangible, clear-cut roadmaps for action and transparent reporting of corporate impact on a wide range of metrics.

ESG is a guideline to reduce risk and protect profits

Sustainable investing will drastically reshape the market. According to Simfund, 2020 saw institutional investors invest $288 billion in sustainable assets globally. That is a 96% increase YoY.

Some investors once viewed sustainability targets as secondary to the overall financial health of a business. Yet recent data suggests that companies actively pursuing ESG outperform companies that don’t in terms of value – both overall and relative to their industries.

According to Ioannis Ioannou of London Business School “[The] scholarly body of evidence suggests a positive causal link between truly integrating social responsibility into the way that you do business and financial performance in both the short and long term.”

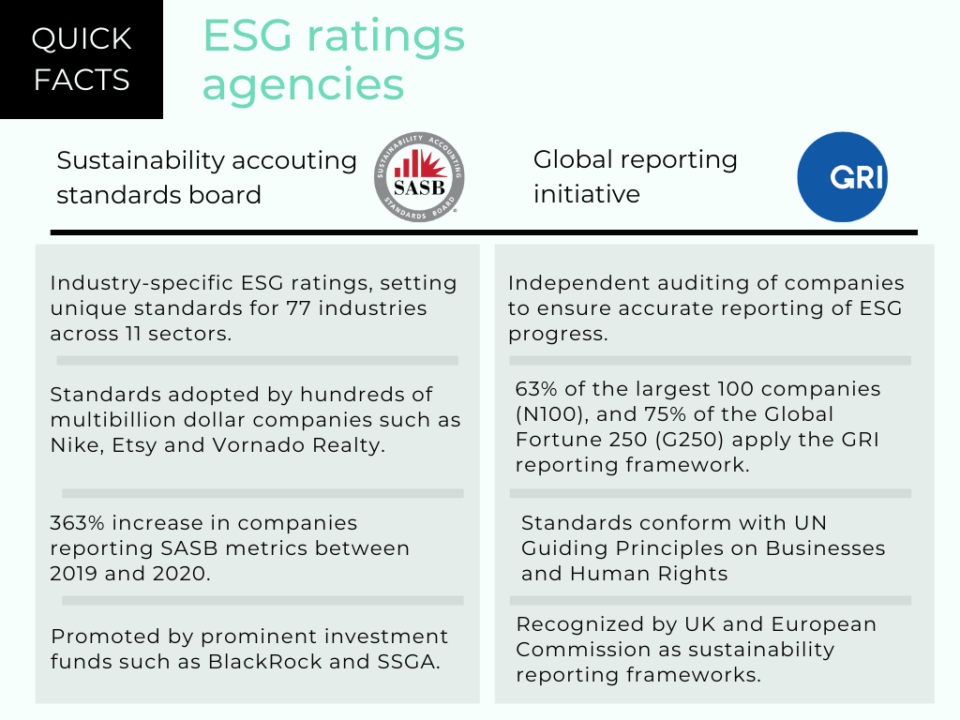

ESG-oriented approaches reveal risks and blind spots that other, more traditional strategies miss. For example, climate change impact is traditionally given a headline measure—the carbon footprint of a company. Today, standards bureaus like SASB look at the impacts of climate change holistically and assess how these risks apply directly to different industries. The SASB will assess a company based on its preparedness for damage to assets, disruptions to supply chains, increased regulation and many more direct risks of climate change.

The standards bureaus’ deep material analysis offers insight into the long-term value of a company by exposing risk in an actionable way. Lowering risk is crucial for the longevity and performance of a company.

What is ESG, exactly?

ESG is a standard for companies to use when seeking to demonstrate their commitment to sustainability and to generate interest from socially responsible investment funds. Compared to traditional methods of demonstrating responsible corporate citizenship like CSR, ESG is far more data-driven, with a strong focus on transparency and reporting according to well-defined guidelines.

Today, there are a number of different frameworks in use, established by different stock exchanges and institutions. The frameworks rate companies based on the organization’s actions on climate and environment, how pro-social and human-centric the company is, and how effective corporate strategy is. This can be assessed across 3 pillars using multiple variables.

Environmental:

Energy efficiencies, carbon footprints, greenhouse gas emissions, deforestation, biodiversity, climate change and pollution mitigation, waste management, water usage

Social:

Labor standards, wages and benefits, workplace and board diversity, racial justice, human rights, talent management, community relations, privacy and data protection, health and safety, supply-chain management, other human capital, social justice issues

Governance:

Corporate board composition and structure, strategic sustainability oversight and compliance, executive compensation, political contributions and lobbying, bribery and corruption

Starting on a corporate ESG strategy

While today’s ESG frameworks are both more comprehensive and tougher than past standards, they are also pragmatic systems – the people who designed them want as many companies as possible to become ESG compliant. Put simply—ESG frameworks are set up to encourage entry.

For this reason, companies in the early stages of their ESG strategy are not expected to be at an optimum level of sustainability in all categories. What matters is that they show a demonstrable commitment to transparency and that the company has established a roadmap to sustainability covering the three ESG pillars. Following this, the company’s progress, whether rapid or incremental, must be dutifully tracked and disclosed on a fixed schedule, supported by third-party validation.

The success of a company’s ESG strategy relies on foundations that are laid at the beginning, and what tools are in place to ensure subsequent consistency in data collection and reporting. Successful ESG implementation should start with close coordination between all relevant parties inside the company, establishing what data each department is able to provide towards target metrics and looking to identify and remove any double reporting or misaligned reporting.

The guiding concept must be to establish a single source of truth—it is the sine qua non of pursuing a viable ESG strategy. Creating and managing a single platform centralizing and aligning data is a cutting-edge field in corporate management, comprising not just tracking across all three pillars of ESG, but a holistic understanding of the company’s business.

Keeping at the bleeding edge of this complex data problem and providing a holistic understanding of the company for management requires the proper digital and social tools and systems to collect and report data. This task’s complexity is one of the main reasons that many companies now prefer to find a sustainability partner to oversee this process rather than trying to manage everything internally.

The race to adopt ESG standards

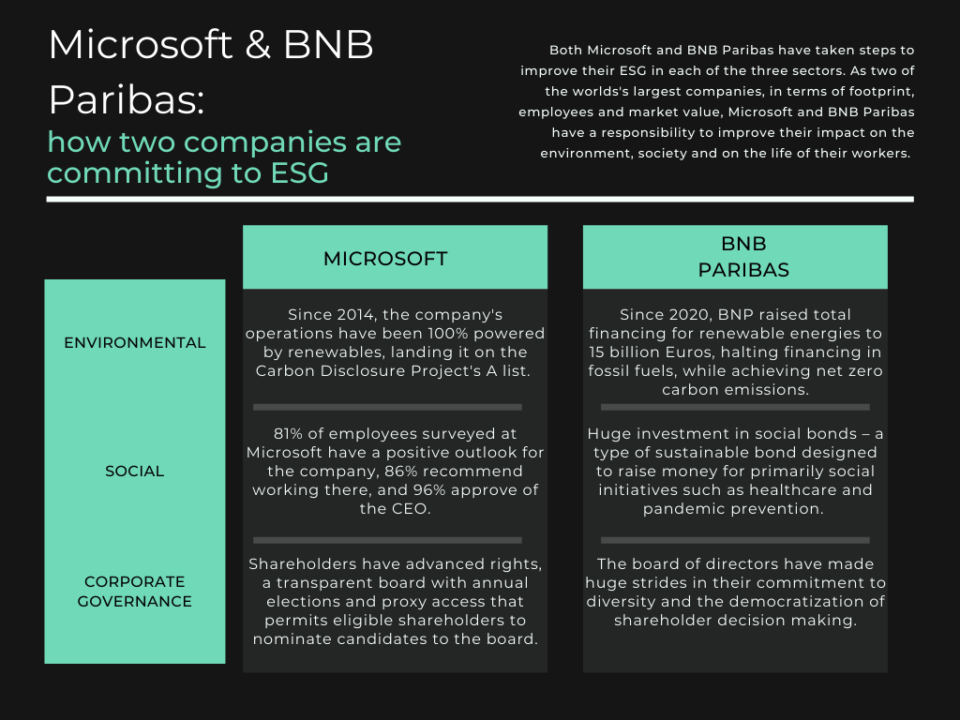

The past year saw a massive interest in ESG—there was a 363% increase in companies adopting SASB standards in 2020. Many firms pledged to integrate ESG goals as a core strategy going into 2021. Some firms that are heading enjoying the benefits:

ESG is the modern business revolution

ESG shows no signs of slowing down. All signals suggest this is an enduring trend with huge growth potential in the future. A number of principal factors are driving this.

Funding flows to sustainable investment funds surpassed $1 trillion by the end of 2020. Deloitte has forecast that ESG-backed assets could grow by as much as three times the pace of non-ESG assets and comprise half of all professionally-managed assets in the US as soon as 2025.

In BlackRock’s 2021 letter to CEOs, it announced that all of its almost $7 trillion assets under management would be directed by ESG metrics. This led to the establishment of the Net Zero Asset Managers Initiative, a group of 30 of the world’s biggest asset managers pledging to achieve net-zero carbon emissions across their portfolios by 2050.

Policymakers are making ambitious changes globally. China has pledged to achieve carbon neutrality by 2060 – with forecasts suggesting it will clear this hurdle easily. The Korean stock exchange (KRX) has announced new rules that require companies over $1.8 billion in value to provide ESG disclosures by 2025 to remain listed. This requirement will apply to all companies by 2030 on a ‘comply or explain’ basis. This is also in line with the Hong Kong Stock Exchange’s plans.

ESG starts at work

To begin an ESG strategy, both the work and the workplace must be considered from a new perspective. Are your dining services sustainably sourced? How are you improving corporate dining satisfaction? How are you reducing your facility’s energy use, while minimizing waste? Are your workers satisfied with their workplace experience? How are you tracking these targets? These questions aren’t for management’s idle musing—each answer is actionable—a tactic to meet an ESG strategy.

Data-driven approaches are holistic approaches, deeper than simple headline targets like carbon neutrality. These can only truly be effective with a bottom-up approach, born from a constant virtuous cycle of observation, iteration, and improvement.

Today, with IoT and smart building technology, the workplace can be seen as a solvable problem. Positive changes made to the work environment will produce a positive cultural benefit—workers will believe what they see, and practice accordingly.

The upward spiral of observation, iteration, and improvement is built on the constant generation of and action on data, including energy use via energy management contracts, digital twin, sustainable corporate dining, worker housing, and data-driven management.

ESG As a Future-Oriented Strategy

The task ahead for businesses adapting to ESG standards is daunting—but it is a profit and investment driver for any business aiming toward the future. Partnerships are the most common option for a business looking to avoid the extreme costs and learning curve of bootstrapping an ESG initiative.

Partnerships in facilities management and offer immediate cost reductions and contribute heavily to the development of a single source of truth—the unified data repository around which the best and most viable ESG strategies are built. Cutting-edge partners offer services like digital twin, IoT-based facility management, and gourmet corporate dining. Developing human capital and reducing costs are critical tactics in ESG strategy.

Meeting ESG standards will make the difference between success and failure in an environment racing to change how business is done best.