On July 16, China’s national carbon emission trading market opened. More than 2,000 power sector enterprises—accounting for more than 40% of the country’s carbon emissions—entered the market as the first batch of trading entities. On the first day, the average transaction price was 51.23 RMB / ton, the turnover volume was 4.104 million tons and the business volume exceeded 210 million RMB.

So what is carbon trading? Why the need to establish a nationwide unified carbon-trading market? How will this market affect enterprises with carbon emission demands? Here is what you need to know.

What is carbon trading?

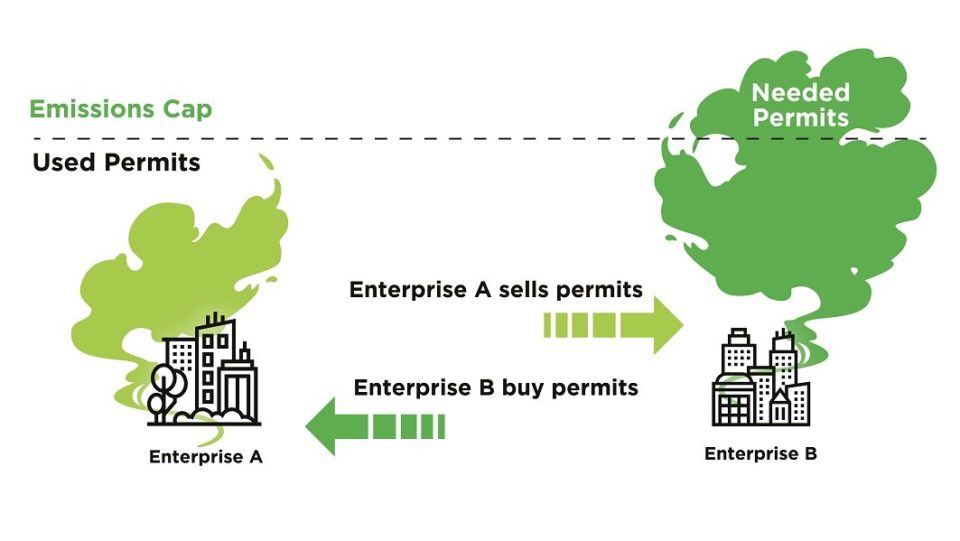

Carbon trading, also known as carbon emission allowance (CEA) trading is a market-based mechanism in which carbon dioxide emission allowances are traded as commodities. The carbon market does not actually buy and sell CO2. What it trades are quotas, or allowances, for energy enterprises, industrial plants or other buildings to emit a certain amount of CO2. If a site or building reaches its emissions cap, it must purchase more emissions allowances as a price per ton of CO2 (tCO2) from the carbon trading market. This is also known as a cap-and-trade system.

Before trading, the government will determine the required total amount of local emissions reduction and supply market entities such as enterprises with a quota of allowances based on that figure. If an enterprise emits more than its allowed quota, it has to buy allowances from the market. On the other hand, if a company’s actual carbon emissions total less than the quota, the remaining quota can be sold in the market. This way the enterprises which perform better in terms of greenhouse gas emissions generate a value.

Why the need to establish a nationwide unified carbon market?

China has already proposed the national initiative to reach peak carbon dioxide emissions before 2030 and achieve carbon neutrality before 2060. Both initiatives were reinforced at the Two Sessions earlier this year when the politburo announced the contents of the new five-year plan. Establishing and gradually improving the national carbon market is one of the core policy tools to achieve these goals.

China’s national carbon market breaks geographical and technology constraints and enables carbon abatement to be produced wherever it is more efficient and cheap, which is expected to significantly reduce the cost of reducing total emissions. The first batch of enterprises included in the national carbon market emits more than 4 billion tons of carbon dioxide, which means that China’s carbon trading market will become the largest carbon emissions trading market in the world.

Who can participate in carbon market trading?

At present, the market is in the initial stage, with 2,225 power generation enterprises taking the lead in trading. However, it is predicted that as the market improves and matures, more industries, industrial and commercial enterprises will enter into the emissions trading market.

The Ministry of Ecology and Environment of the People’s Republic of China has already carried out carbon emission data reporting and verification for enterprises in related industries. In addition to the power generation industry, the report also covers building materials, nonferrous metals, steel, petrochemical, chemical, papermaking, aviation, etc. In the future, with the expansion of the carbon market, enterprises’ demand for energy conservation and emission reduction will continue to increase, thus they will be more inclined to use clean energy and low-carbon energy.

Meanwhile, companies currently not involved in the carbon market can take steps to get their total emissions and carbon impact under control. There are a variety of energy management solutions that can relatively quickly shave off total greenhouse gas contributions such as HVAC optimization and compressed air leak management.

How can companies adapt to the new carbon market?

The best bet for companies who need a quick transition to low carbon operations is to find a strategic partner. A good energy partner can identify exactly where your operations have the highest carbon impact and help reduce it without affecting your bottom line. There are even options to do so with zero CAPEX needed. One of those methods is to collaborate with an ESCO or Energy Service Company that can take over energy management and retrofits, but there can be downsides especially when it comes to discrepancies over transparency. That’s one of the reasons Aden created Aden Energies, which uses Akila—an AI+IoT platform—to track those metrics for total transparency and use machine learning to optimize energy efficiency and reliability.

Moving towards a zero-carbon future

Total carbon emission controls benefit the whole society. However, some companies will face many challenges such as regulatory compliance, cost reduction and efficiency improvement. Nevertheless, businesses still need to keep up with the quick pace of change and respond positively. Finding a solid energy partner can help move your business in the right direction no matter which stages your business is at regarding energy efficiency management or sustainable development. With the opening of the carbon trading market and the national 2030 and 2060 initiatives, there is no better time to start than right now.